For this past week, gold dropped $79.50, and silver lost an

astonishing 18.42%. This post will attempt to analyze the extent of the damage, and try to determine what to expect next.

The first chart that I would like to log is a daily chart of

GLD:

What you will observe in the above chart is that GLD failed exactly at the psychologically significant $100.00 area. The bears gained control of GLD at this level, and this was evidenced by the gravestone doji that formed on Monday in the the gold futures chart.

Afterwards, there was some very heavy selling that occurred on extremely heavy volume. This level of volume has never been seen before in this ETF.

Finally, on Thursday, GLD gapped below the dashed line, which is the 50 day moving average, and closed on Thursday near the lows of the session. Unfortunately, there is nothing bullish about this series of events.

The next chart is a chart of GLD, but this time we have a weekly perspective.

This week formed a very large red candle with no lower wick. In my view, this means that the bears are in complete control of this market for the time being. Furthermore, I find the magnitude of shares trading hands this week significant.

I mentioned in the last post that I thought a capital preservation mentality was warranted at this time. To me, this means hedging existing long term positions against market volatility. One way that I was able to do this is by purchasing a gold bullion bear ETF. To read more about these ETFs, click here.

Essentially, if gold bullion drops by, say, 5%, then this ETF should rise by approximately 10%. I think these products are a great idea, as they allow investors to speculate on the direction of commodities without getting involved in futures trading, or allow investors to protect themselves in downward markets. (By the way, last week, another ETF was launched that follows grains. The ticker symbols are HAU.to and HAD.to)

Essentially, if gold bullion drops by, say, 5%, then this ETF should rise by approximately 10%. I think these products are a great idea, as they allow investors to speculate on the direction of commodities without getting involved in futures trading, or allow investors to protect themselves in downward markets. (By the way, last week, another ETF was launched that follows grains. The ticker symbols are HAU.to and HAD.to)

The next chart is a weekly chart of SLV.

What I wanted to take note of is that SLV failed at the $200.00 level after being, what I would say, overheated. Again, we have a very bearish weekly candle, but at least we are in the proximity of some potential chart support.

Next I wanted to make note of a daily CandleVolume chart of SLV:

What I like about this this type of charting is the visual representation of volume. Larger candles mean higher volume, and we had some big ugly candles put in this week. I also found it interesting that SLV got blown out of its bollinger band on Friday. Unfortunately, again, I see nothing bullish about the above chart.

In the last post, I said that I had finally thought that the USD was looking oversold. This week, we had a bounce in this currency after putting in a bullish candle.

In addition, my intermarket analysis is indicating that there is more USD strength coming next week. However, I do not expect the USD to surpass the red resistance area pointed out below:

What I have noticed whenever gold has a correction, and there have been a few over the last 5 years, is that 'analysts' from Bloomberg or MSNBC come out and declare that the bull market is over, and the previous run up was nothing more than a bubble.

I guess since these guys were cheer leading the Nasdaq bubble, and were completely oblivious to the housing bubble, that we can expect them to be experts in this area.

In my view, gold is nowhere near what I would consider to be a bubble. Only about 1.5% of investment monies worldwide are in invested in gold or gold shares, and probably fewer than 1 tenth of 1 percent of North Americans own precious metals. Furthermore, if one were to take the market capitalization of all the gold stocks in the HUI index, it would still be less than the market capitalization of one company in the DOW Jones, such as Coca Cola.

Also, judging by the fact that nobody ever signs up for the free precious metals investing kit I advertise on my blog, the sentiment is just not lined up for what I would consider a bubble. When your neighbors start talking about the gold they just picked up, or if you hear your friends at work talking about how much money they made in the gold stocks they bought, then you know we are in trouble.

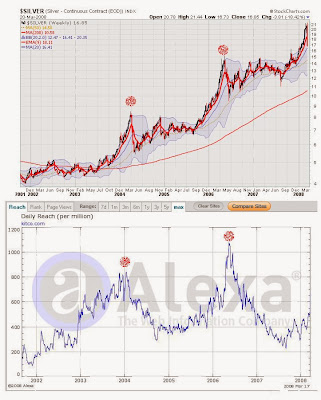

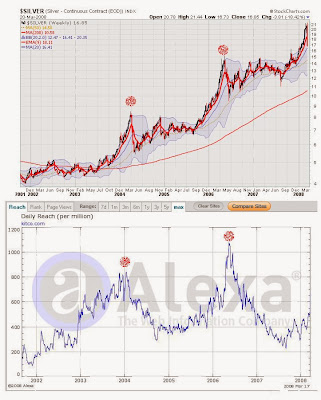

Another way I like to look at sentiment is through analyzing the number of hits popular gold sites, like Kitco, receive. Generally, when gold and silver start rising very quickly, the general public begins to get interested, and may begin to visit sites such as these.

Usually, by the time the public begins to get interested, the move is over, and the professionals start to unload their positions, and gold and silver come crashing down. Here is a chart the exemplifies this:

In the above chart, we have the price of silver, and in the bottom panel, we have the number of hits to Kitco.com. What I find interesting is that during this recent run up, the public never really got excited like they did in previous run ups, which I think further disproves the bubble theory.

In the above chart, we have the price of silver, and in the bottom panel, we have the number of hits to Kitco.com. What I find interesting is that during this recent run up, the public never really got excited like they did in previous run ups, which I think further disproves the bubble theory.

Therefore, the bottom line, in my opinion, is that, while gold and silver are showing no signs of a bottom at this time, the long term bull market is still healthy, and I do not see this correction as being any different from the many other corrections that precious metals have faced before.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)