I think that it is safe to say that most gold traders keep an eye on the US Dollar. This is because the price of gold and the value of the US Dollar trend in the opposite direction. The reason for this is that gold is denominated in US Dollars, so when the dollar falls, it will take more dollars to buy an ounce of gold. It is therefore helpful to look at the

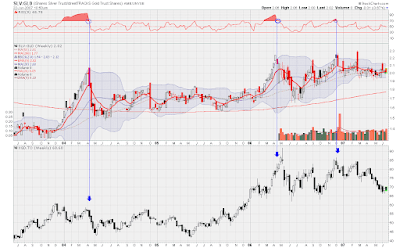

USD as a means for analyzing the price of gold. Below is a daily chart of the

USD with some of my own annotations that I use for my own trading.

Whenever I analyze the

USD I look for overbought/oversold indications on the RSI indicator. If the Dollar is overbought, it has a greater

probability of decreasing, which would be bullish for gold and gold stocks. However, it is important to realize that just because RSI is overbought does mean it will decrease, as RSI can always get more overbought. Because of this, I always look for a confluence of indications to strengthen my opinion.

Another important indication I look at when analyzing the

USD is the position of the 200 day moving average. Since the Dollar is in a bear market, you will notice that it is trading below this level. Notice also that when the bulls push the price to the 200

DMA, the bears step in, and take control. This

occurred in the above chart in the middle of October, 2006. Furthermore, in the middle of October, the

USD was in overbought territory, which added to the bearishness. You now had two pieces of evidence that the Dollar could fall. This is what I mean by a confluence of indications. Gold bottomed out at exactly the same time as the US Dollar topped.

Finally, I use support and resistance lines to help me understand the probable direction of prices. Notice that in the middle of April, 2007, the

USD broke through the line of support I labeled R1. I labeled it R1 because broken support always becomes new resistance. Interestingly, R1 became resistance in late May, but subsequently broke through it in the middle of June. The next line of resistance, labeled R2, is the downtrend line. Like clockwork, the

USD has ceased at this level, and headed south. Should this line eventual fail, then the third line of defense will be the 200

DMA.

In summary, look for indications such as RSI, moving averages, and trend lines to help you understand the price of the

USD, which, in turn, will help you understand the price of gold.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)