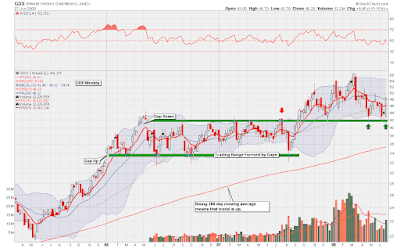

Above is a weekly chart showing GDX, the gold stocks ETF. What I wanted to point out is that gold stocks experienced a very nice bounce off a major area of support. I now feel that the short term trend for gold stocks has moved from neutral to up, so I decided to go long this sector, and will remain long until the short term trend changes.

Above is a weekly chart showing GDX, the gold stocks ETF. What I wanted to point out is that gold stocks experienced a very nice bounce off a major area of support. I now feel that the short term trend for gold stocks has moved from neutral to up, so I decided to go long this sector, and will remain long until the short term trend changes.The next chart is a weekly chart of silver, which also rallied this past week:

Ever since silver corrected from the $21.00 an ounce area, I have been slowly and steadily buying more and more silver coins, which allows me to dollar cost average. In both charts posted so far, I feel that the long term trend is up, so this means that dollar cost averaging is a strategy that has a high probability of paying off. Buying or selling in the direction of the long term trend always puts the odds in your favour.

In addition to feeling bullish on gold stocks and silver, I feel that copper is looking very strong right now. Unlike oil or gold, copper rarely gets any mention in the media, but is something that can make you a lot of money nonetheless.

If copper can decisively break above the $4.00 a pound resistance area, then I think there is the potential for an explosive move higher. In my previous post, I mentioned an ETF that follows the price of copper.

If copper can decisively break above the $4.00 a pound resistance area, then I think there is the potential for an explosive move higher. In my previous post, I mentioned an ETF that follows the price of copper.Also in my previous post, the theme that commodities will likely outperform stocks was mentioned. I think that this trend will begin intensifying in the coming weeks. Part of the reason for this belief lies in how ugly the Dow Jones charts look (monthly, weekly, or daily.)

The above chart shows the Japanese Yen on the top panel and the Dow Jones Industrial Average on the bottom panel. For the last month, I thought that the Yen would start rallying and this would take stocks down. However, for the most part, the Yen has fallen along with the Dow. The way I see this is that if the Dow can't even rally with the help of a falling Yen, then we are in serious trouble when the Yen eventually does turn around.

If the Yen begins rallying, it will start unwinding the so called carry trade, and cause stocks to plummet. The Yen appears to be bouncing now off its 200 day moving average, so this is a chart I will keep my eye on next week, as things may get very interesting.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

No comments:

Post a Comment