The above chart is a weekly chart of GDX. Despite another round of declining prices, gold stocks are still holing this important support area. In my opinion, this level of support is key, and if it is taken out, I will have a difficult time remaining bullish on the sector.

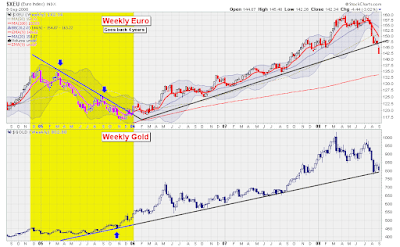

On the other hand, the Euro has broken down badly, and is no longer in a weekly uptrend:

The fact that the Euro has broken down is certainly not an asset to the gold bulls, but it is not necessarily a liability. It is still possible for gold to rally in a falling Euro environment:

Another commodity that caught my eye this week was natural gas. Natural gas prices have collapsed, as this weekly chart shows:

As you can observe in the above chart, natural gas is at a potential level of support, and has formed a bullish candle. Personally, I would not buy this ETF for my trading account, as it would violate my trend trading criteria. However, adding this ETF into a long-term trading account (more than 5 years), such as an RRSP, could be wise.

For my trading account, I was blown out of the positions I mentioned last week. The long positions struggled in the face of the TSX's 1,000 point correction. Whipsaws will always be apart of trend trading, and the only way to avoid them is to stop trading.

As part of my method of managing risk, I always try to go long and short different stocks so that if there is a severe correction, I will be partially protected. Here are some of the positions I took this week and continue to hold:

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

No comments:

Post a Comment