With markets in free fall this week, central banks injected an unfathomable amount of liquidity into the markets. When money is injected into circulation, it is not withdrawn from some sort of reserve (the Federal Reserve does not have any reserves -and is not federal), but is created out of thin air.

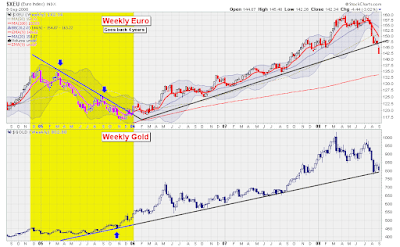

One sure way of detecting this type of activity is through monitoring of the price of gold. The amount of gold in circulation is relatively constant, so when the amount of paper dollars in circulation expands, there are more pieces of paper chasing a finite amount of gold, so the price of gold rises.

The past week saw one of the sharpest rallies in gold ever. Therefore, it can only be reasoned that the amount of liquidity dumped into circulation was also one of the largest ever. This increase in liquidity waters down the purchasing power of the US Dollar.

What is interesting is when one looks at how the Dow Industrials performed this week when priced in real money, such as gold, rather than in paper currency. In currency terms, the Dow was only down slightly for the week, but in real money, the Dow has lost a tremendous amount of its purchasing power, due to the fact the the Dow is denominated in dollars that are being watered down:

The markets did rally on Friday, but, in my opinion, this was not due to any change in the fundamentals, but due to changes in regulations socialistically put in place by governments. Not being allowed to short sell banks will not solve anything longer term.

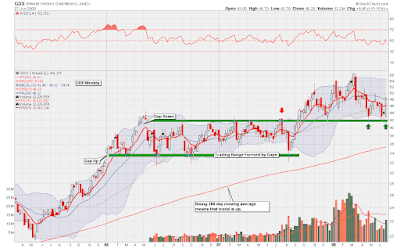

Anyway, now, more than ever, I feel bullish on gold and silver. Here is a long-term chart of the status of this great bull market:

The above chart is a monthly chart of gold, and goes back about 23 years. In my view, the chart shows that we are in a very strong bull market, which, like any trend, is more likely to continue at this point in time than to turn around.

This chart does not necessarily suggest that gold will rise or fall next week or next month. In fact, I have no idea what will happen next week or next month. I feel that it is a more profitable methodology to follow trends rather than try to predict them.

Over the past several several years, I have debated whether if it is more profitable to try to predict trends or simply follow them. This blog has endeavored to try to predict trends, whereas my other blog discusses the wisdom of simply following them.

Through an unbelievable amount of study, I am now fully convinced that the strategy of simply following trends is the superior methodology. As such, I will likely dedicate more effort and time to my other blog from here on in.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)